CAPITAL CREDIT FREQUENTLY ASKED QUESTIONS

Posted: 10/1/2024

Eau Claire Energy Cooperative is more than just an electric utility—it is a cooperative. We are focused on our members and prioritize the needs and interests of our membership above all else. One way we demonstrate this commitment is by returning capital credits to members each year during cooperative month. capital credits, cooperatives can maintain and upgrade their infrastructure, which, in turn, helps keep electricity rates stable and affordable for members. This also allows for more maintenance, meaning less outage time as well as more technology and communication for members.

October is Co-op Month! We are here to celebrate you! This year, Eau Claire Energy Cooperative will return over $897,000 to more than 17,000 members. In fact, ECEC has returned over $21 million to our members since our inception in 1938. Capital credits are a unique benefit of your cooperative membership. Keep an eye out on your October bill for your bill credit!

Frequently Asked Questions

What are capital credits?

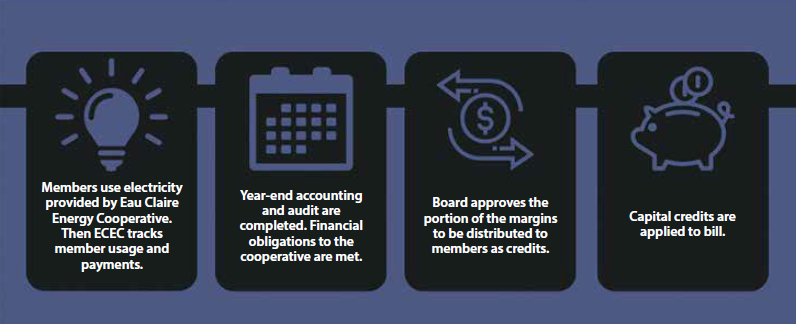

Capital credits are a unique financial benefit of being a member of Eau Claire Energy Cooperative. As you pay your monthly electric bills, Eau Claire Energy Cooperative uses funds to grow, operate, and maintain a safe and reliable electrical system. Any money received over and above the cost of doing business is called margins. Your portion of the margins is then returned to you in the form of capital credits. They represent your ownership stake in the cooperative. When you become a member and pay your electric bill, you are essentially investing in the cooperative. These investments, or capital credits, are allocated to members annually based on their usage of electricity and the cooperative’s financial performance. Being a member of ECEC means these credits go back to you, our members, instead of to a group of shareholders. That is the cooperative difference!

Why are capital credits important?

Community Ownership: Unlike investor-owned utilities, cooperatives are owned and operated by the people they serve—the members. Capital credits reflect this ownership, giving members a say in how the board of directors is elected. This democratic structure ensures that decisions made by the cooperative align with the community’s needs and values. Stability and Affordability: By retaining and reinvesting capital credits, cooperatives can maintain and upgrade their infrastructure, which, in turn, helps keep electricity rates stable and affordable for members. This also allows for more maintenance, meaning less outage time as well as more technology and communication for members.

How do I earn capital credits?

You earn capital credits by being a member of an electric cooperative and paying your electric bills. The amount you earn is typically based on the amount of electricity you use and the cooperative’s financial performance for that year.

When will I receive my capital credits?

Each year, capital credits are applied annually as a credit to your billing due in October. To view how much you got back in capital credits, view the upper right corner of your October bill. You can view your bill in your SmartHub account by visiting https://www.ecec.com/my_account/ smarthub#smarthub_login.

Can I get my capital credits paid out?

Capital credits use a revolving system where the money is returned to you over time. This helps the cooperative maintain financial stability, which allows for reliability and affordability for all members. Members will receive an annual capital credit retirement applied as a bill credit in October of each year.

What happens to my capital credits if I move or no longer use the cooperative's electrical services?

Capital credits are associated with you and your membership and stay with you even if you move or no longer use the cooperative’s electrical services. Alternatively, you will receive your capital credits as checks until your funds are all retired. This is why it is important to keep your forwarding address up to date with ECEC, even after you move out of ECEC service territory.

Are capital credits taxable?

It’s advisable to consult a tax professional for guidance on reporting capital credit refunds on your income tax returns.